In today’s digital age, having a reliable and secure Online Payment Service is crucial for any business that wants to accept online payments. With numerous options available, it can be challenging to determine which payment gateway service is the best fit for your business. To help you make an informed decision, we have compiled a list of the top 6 Online Payment Services that offer exceptional features, security, and ease of use. Let’s explore each of them in detail:

Table of Contents

What is Online Payment Service?

A Online Payment Service is a secure intermediary between a merchant and a customer’s bank that facilitates online payments. It acts as a bridge between the merchant’s website or point-of-sale (POS) system and the customer’s bank, ensuring that sensitive payment information is securely transmitted and processed.

Why can Online Payment Service help businesses?

- Improve security: Online Payment Service employ advanced security measures, such as encryption and tokenization, to protect sensitive customer data from unauthorized access. This helps businesses comply with data privacy regulations and builds trust with customers.

- Enhance convenience: Online Payment Service streamline the checkout process, making it easier for customers to complete purchases online or in-store. This can lead to increased sales and improved customer satisfaction.

- Streamline fraud detection: Payment gateways incorporate fraud prevention tools to identify and block suspicious transactions. This helps businesses reduce fraudulent activity and minimize losses.

- Offer versatile payment options: Payment gateways typically support a variety of payment methods, including credit cards, debit cards, e-wallets, and mobile payments. This allows businesses to cater to a wider range of customers and preferences.

- Provide detailed transaction data: Payment gateways provide merchants with detailed transaction data, which can be used to analyze sales trends, identify customer behavior, and make informed business decisions.

Benefits of Using Online Payment Service:

- Increased sales: By providing a secure and convenient checkout experience, payment gateways can help businesses attract more customers and increase sales.

- Reduced fraud: Payment gateways’ fraud prevention tools help businesses minimize fraudulent transactions, protecting their revenue and reputation.

- Enhanced customer satisfaction: By offering a seamless checkout process and protecting customer data, payment gateways can improve customer satisfaction and loyalty.

- Streamlined operations: Payment gateways can automate the payment processing process, freeing up businesses to focus on other aspects of their operations.

- Scalability: Payment gateways can accommodate businesses of all sizes and growth stages, providing the flexibility to handle increasing transaction volumes.

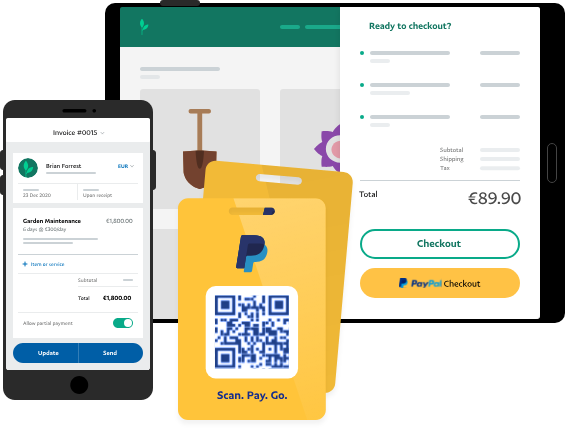

1. PayPal

Website: PayPal

PayPal is a widely recognized and trusted Online Payment Service that allows businesses to accept payments securely and conveniently. With PayPal, you can accept payments from customers around the world, whether they have a PayPal account or not. It offers robust fraud protection, seamless integration with various e-commerce platforms, and a user-friendly interface. PayPal is an excellent choice for businesses of all sizes.

PayPal can benefit your business in several ways.

Firstly, it provides a convenient and widely used payment option for your customers, increasing the likelihood of completing transactions. This can lead to higher conversion rates and customer satisfaction.

Additionally, PayPal offers a secure payment platform, reducing the risk of fraud and ensuring the safety of financial transactions.

Moreover, the integration of PayPal on your website can streamline the checkout process, enhancing the overall user experience. PayPal’s global reach allows you to tap into a broader customer base, facilitating international transactions and expanding your business’s market presence. The platform also provides tools for invoicing and managing transactions, simplifying your business operations. Overall, incorporating PayPal can contribute to the growth and success of your business by offering a reliable and efficient payment solution.

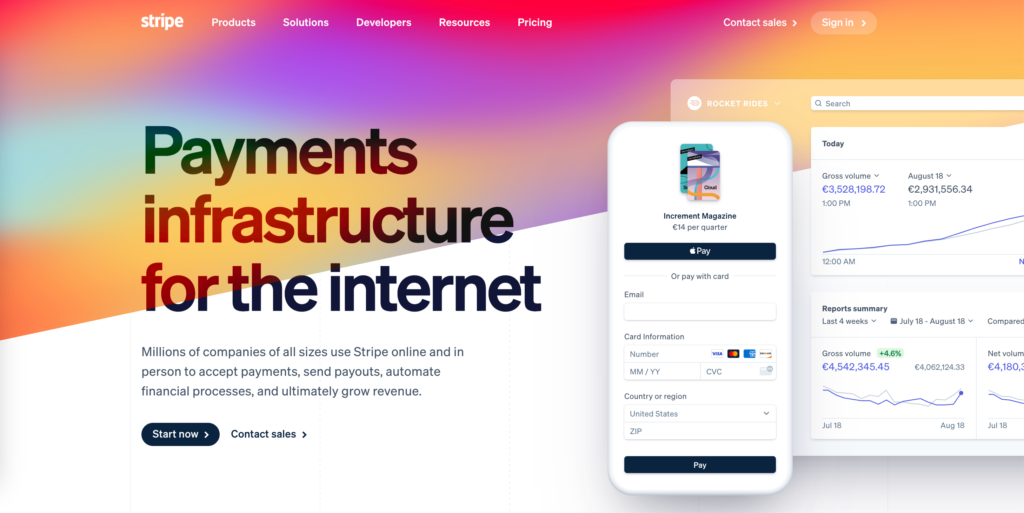

2. Stripe

Website: Stripe

Stripe is a powerful payment gateway service that provides businesses with a comprehensive set of tools to accept payments online. It offers a developer-friendly platform, making it easy to integrate with your website or mobile app. Stripe supports a wide range of payment methods and currencies, making it ideal for businesses with a global customer base. With advanced security features and customizable payment forms, Stripe is a top choice for businesses looking for flexibility and scalability.

Stripe can significantly benefit your business by simplifying online payment processing. It provides a seamless and secure way for your customers to make payments, enhancing their overall shopping experience. With Stripe, you can accept various payment methods, including credit cards and digital wallets, making it convenient for a broader range of customers.

Stripe’s integration capabilities allow you to embed payment functionalities directly into your website or mobile app, creating a more streamlined checkout process. This can lead to higher conversion rates and increased customer satisfaction. Additionally, Stripe offers advanced features such as subscription billing, allowing you to easily manage recurring payments for subscription-based services.

Stripe provides robust security measures to protect sensitive customer data, reducing the risk of fraud and enhancing trust in your business. The platform also offers detailed analytics and reporting tools, giving you valuable insights into your business’s financial performance.

Additionally, Stripe’s global reach enables you to expand your business internationally, as it supports multiple currencies and provides localized payment methods. This can help you tap into new markets and increase your customer base.

3. Shopify Payments

Website: Shopify Payments

Shopify Payments is a payment gateway service specifically designed for businesses using the Shopify e-commerce platform. It offers seamless integration, eliminating the need for third-party payment providers.

Shopify Payments provides a secure and reliable payment processing solution, allowing businesses to accept various payment methods, including credit cards, digital wallets, and more. With competitive transaction fees and easy setup, Shopify Payments is an excellent choice for Shopify store owners.

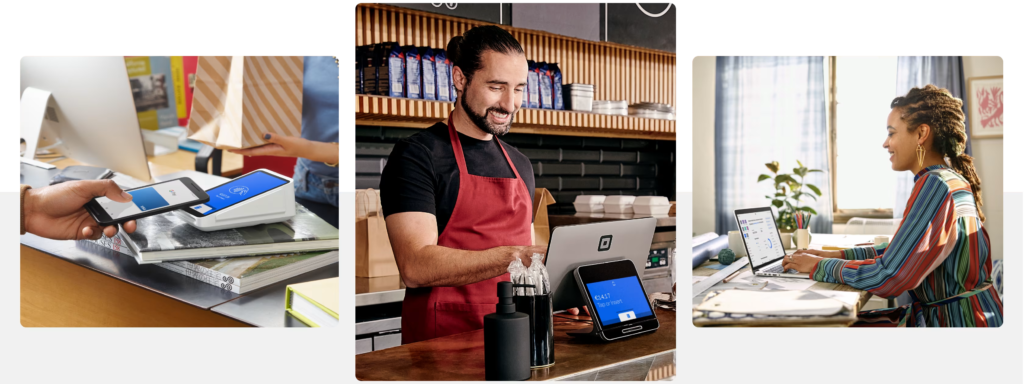

4. Square

Website: Square

Square can significantly benefit your business by providing a comprehensive suite of tools and services designed to streamline various aspects of your operations. First and foremost, Square offers a user-friendly point-of-sale (POS) system that enables you to accept payments seamlessly, whether in-store or online. This can enhance the overall customer experience and increase sales by providing convenient payment options.

Moreover, Square provides robust analytics and reporting tools, giving you valuable insights into your business performance. These analytics can help you make informed decisions, identify trends, and optimize your strategies to maximize profitability.

Square’s inventory management system simplifies tracking and restocking, helping you maintain optimal stock levels and avoid overstock or stockouts. This can lead to improved efficiency and reduced operational costs.

Additionally, Square offers tools for customer relationship management (CRM), allowing you to build and maintain customer relationships through personalized communication and loyalty programs. This can contribute to customer retention and repeat business.

Square’s online capabilities extend beyond payments, providing you with e-commerce solutions, website building tools, and online store management. This broadens your reach and allows you to tap into the growing market of online shoppers.

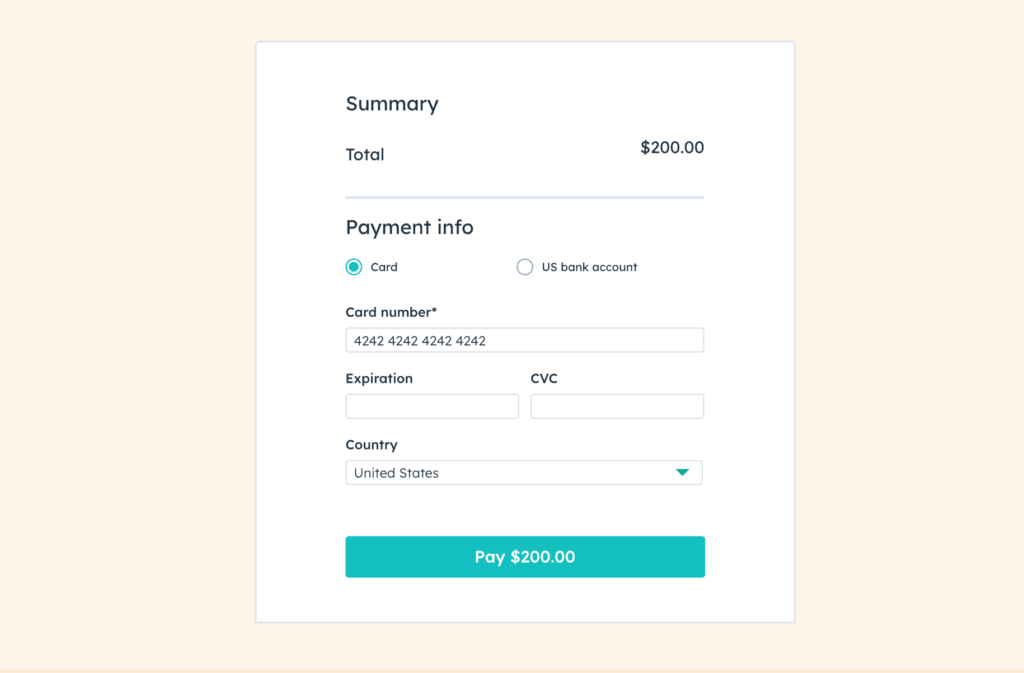

5. HubSpot Payments

Website: HubSpot Payments

HubSpot Payments can streamline your business operations by integrating payment processing directly into the HubSpot platform. This allows you to manage customer interactions, sales, and payments all in one place, fostering a more efficient and organized workflow. With this integrated system, you can provide a seamless experience for your customers, making it easier for them to make purchases and payments.

By using HubSpot Payments, you can gain insights into your sales and financial data through HubSpot’s analytics and reporting tools. This can help you make informed decisions, track your revenue, and understand customer behavior, ultimately contributing to better business strategies.

The platform also facilitates the automation of payment processes, saving you time and reducing manual errors. This can be particularly beneficial for recurring payments, subscription models, or any other transactions that require regular processing.

Additionally, HubSpot Payments prioritizes security and compliance, ensuring that your customers’ payment information is handled securely. This helps build trust with your customers and protects your business from potential risks associated with payment processing.

.png#keepProtocol)

6. Helcim

Website: Helcim

Helcim is a Online Payment Service that focuses on providing transparent pricing and excellent customer support. It offers a range of features, including online payments, recurring billing, and virtual terminal for in-person payments. Helcim prioritizes security and compliance, ensuring that your customers’ payment information is protected. With competitive pricing plans and a commitment to customer satisfaction, Helcim is an excellent choice for businesses looking for a reliable payment gateway service.

The platform offers transparent pricing with no hidden fees, empowering you to manage costs effectively. Additionally, Helcim emphasizes security, ensuring that your transactions are secure and compliant with industry standards. With their user-friendly interface and customer support, Helcim can help simplify your payment management, allowing you to focus on growing your business.

Conclusion

Choosing the right Online Payment Service is essential for the success of your online business. The 6 payment gateway services mentioned above – PayPal, Stripe, Shopify Payments, Square, HubSpot Payments, and Helcim – offer exceptional features, security, and ease of use. Consider your business requirements, budget, and integration needs when selecting the payment gateway service that best suits your business. With the right Online Payment Service in place, you can provide a seamless and secure payment experience for your customers, ultimately driving your business growth.

Frequently Asked Questions (FAQ)

- What is a payment gateway service?

A Online Payment Service is a technology that enables businesses to accept online payments securely. It facilitates the transfer of payment information between the customer, the merchant, and the payment processor. - Are these payment gateway services secure?

Yes, all the Online Payment Services mentioned in this article prioritize security and employ industry-standard encryption to protect sensitive payment information. - Can I accept payments from customers worldwide with these payment gateway services?

Yes, most of the Online Payment Services mentioned support international payments. However, it’s essential to check their supported countries and currencies to ensure compatibility with your business needs. - Do these payment gateway services charge transaction fees? Yes, transaction fees may apply depending on the Online Payment Service and the specific payment methods used. It’s recommended to review the pricing details of each payment gateway service to understand their fee structure.

- Can I integrate these payment gateway services with my existing e-commerce platform?

Yes, most of the Online Payment Services mentioned offer seamless integration with popular e-commerce platforms. However, it’s advisable to check the compatibility and integration options with your specific platform before making a decision.

Remember to visit the respective websites of each payment gateway service for more detailed information, pricing plans, and specific features. Choose the Online Payment Service that aligns with your business goals, customer needs, and provides a secure and convenient payment experience.